BankruptBaby

Rates are low - until Credit Rating tanks

"But Rates are low - now is the time to to borrow!" they say.

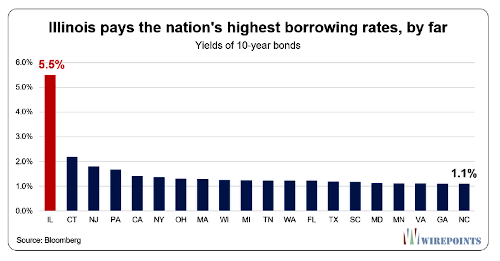

Mish Talk points out Illinois is an excellent example how this is just not true regardless of the overnight rates or bond rates heard on media.

The State is paying 5.85% on $800M bond issue - higher than other States CURRENTLY (see their chart). Illinois has about $42B in bonded debt and $200B pension / Health Care obligations - so no AAA credit rating (bbb).

It is important to note Governments issue bonds every year to cover existing bond buyouts and annual deficit so average rates increase gradually.

Illinois will pay $450M MORE on this issue (over 25 years) than it would had they enjoyed a better credit rating.

Get to work kids! Seems your parents and grandparents promised six-figures for life to government employees and decided you should pay - with a higher Interest Rate.