BankruptBaby

CPP fund should be liquidated to dent Provincial Debt.

The US Social Security fund runs dry in about 13 years. Mass chaos? No. The over 65 crowd will get checks (about 70% of what they get now) as people still paying in.

The Canada Pension Plan faces similar issues but instead of reducing payments (or upping age) Trudeau is forcing young working people to pay hundreds more each and every year – a higher % than any current recipient paid. Canada has done a lousy job loading up this fund previously.

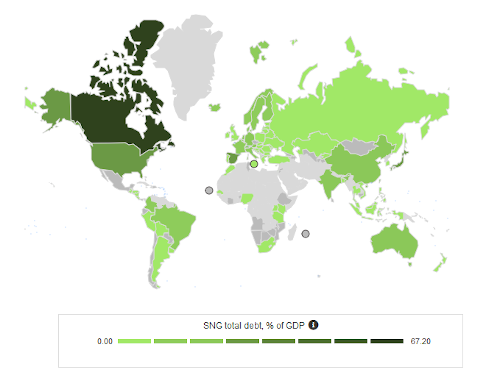

Not only did today's retirees not put enough into the CPP fund - they did not feel like paying for their high wages for services in health care and education (paid mostly Provincially and their biggest expenses by far). Canada's Provinces are the most indebted in the world (% GDP). In 1980, Provincial debt to gdp was half today's. One Province is insolvent now; more to come when rates rise and GDP rises more slowly with flat participation rates for foreseeable future. Sub-Nationals cannot "print" money - all must be borrowed.

The CPP fund has done well recently (as have most Investors) but Provinces are setting deficit records even with today's historically low Interest rates. Both will inevitably regress toward the Mean (Interest rates will rise, massive investing returns will be harder to come by). Drawings from the fund will increase as boomers retire – provincial debt will continue to expand.

Even with no fund the 70% less will be much easier for Canadian seniors to handle in comparison to their US friends – only the super-rich (top 4%) do not qualify for an enhancing welfare check (OAS – Feds biggest expense going forward). Both have had assets inflated with QE - but inflation hurts those just starting out. The CPP fund will lose purchasing power with coming inflation (due to QE) but printed/borrowed/taxed OAS less so.

The massive $1.34 Trillion in Provincial debt (Quebec's not included/applicable) could be reduced mildly to $865 hundred millions with the CPP fund. This reduction may be the difference between default and solvency as rates rise. Only 10% of the fund is invested in Canada so little downside to domestic investment. The only negative is Provinces will delay reforming their unsustainable spending but restrictions could be made conditional on the transfer of the CPP fund.

Best of all for today's over 65 crowd is that their headstones may be less molested by those they directly enslaved in Ponzi schemes (like Provincial debt and the Canada Pension Plan) with less burden put on smaller generations. Time to join the US and pay less CPP - not just change young people more.