BankruptBaby

Employment Insurance + CPP hikes next year?

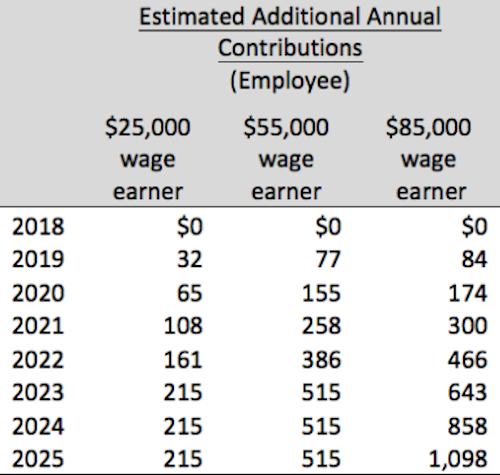

You probably know about the increase in Canada Pension Plan (CPP) Premiums this week. If you make over $60K – you get a 9.3 per cent increase in premiums. Rate and maximum applicable earnings going up. Way higher rate than the Ponzi schemers that are receiving benefits now paid. Rates increase next year again. And the year after that...

Trudeau could have increased beneficiary age one month a year and/or reduced payout amounts by dollars a month but chose to increase premiums for young working people instead. He has not deferred hikes even 1 year due to lock downs even though promised benefits 40 years down the road. Maybe.

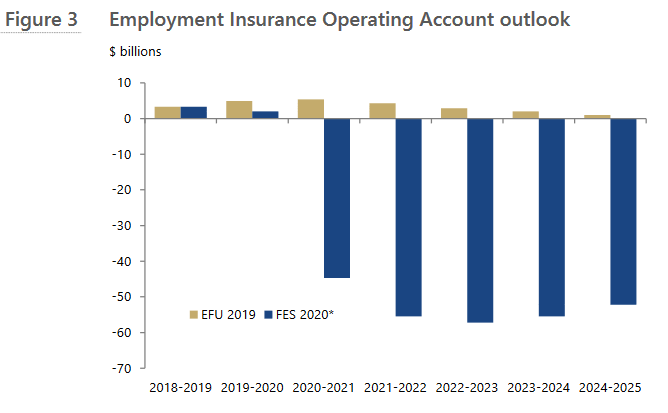

Employment Insurance (EI) is the more immediate concern. Unlike CPP, we saw little attention paid to a recent PBO report on EI:

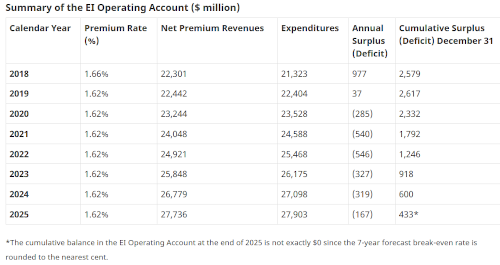

“Under the Employment Insurance Act, the Government must set EI premium rates to generate just enough revenue to ensure that, at the end of a seven-year period, EI revenues equal EI expenses. By law, every dollar paid out of EI must be recouped through EI premiums within seven years.”

No 40 year timetable here; $52B needed in 7 years. Canadians contributed $25B a year pre-lockdowns.

From 2019:

Trudeau loves buying votes with your money. He increased benefits before his second election and extended benefits afterward. He even dramatically reduced hours needed to collect EI as CERB expired. Still, the PBO estimated the shortfall at $52B on Dec 10th 2020. With lock downs extended and even more draconian, it will be more.

Trudeau did not cut CPP benefits and cuts are surely off the table with EI as he needs Atlantic Canadian votes for even a minority and they are power users of EI.

EI are hikes are bad for you but 1.4 times worse for your employer (Employers pay 1.4 times the premiums each employee pays in Canda). Increased premiums will cost jobs - employers will need efficiencies to cover additional expense thereby reducing collections for Government. Even greater premium increases will be required to cover shortfall and the downward spiral will continue. Remember, Canada's workforce growth was almost Zero in 2020 so no greater amount of people to pay.

Look for Premium increases near 20% - it will not be enough so debt (you will have to carry) will cover the rest.

It should also be noted that before this Government scheme was hatched there was another name for EI - it was called a savings account. If you and your employer but your $41 a week into Savings (tax free) at just 2%, you would have $16,500 after 7 years to deal with these Pandemics that come along every 10 years or so.

Massive EI hikes are a sad relization for young people thinking the Government provides things for "Free". Governments pay nothing into your private sector EI account (or CPP). They just take money out. You and your employer will pay more for CPP and EI - If you keep your job of course.

CopyNPaste URL to Share: https://www.bankruptbaby.org/Past-Articles/EIgoingUP/#wbb1