BankruptBaby

Canada has UBI but needs BBL

Government assistance to a single, employable person under 65 in Ontario is $9,646.00 annually. A couple with two children receives $31,000. This sum only includes direct Welfare, Child Benefits and Sales Tax Benefits.

Additional benefits for low Income individuals can include:

Disability (various)

Charity (Governments give $160B+ to Charities)

Over 65 yrs of age (OAS/GIS)

Survivor Allowance (60 – 65 yrs of age)

Government Housing (often called Social or, ironically, affordable Housing)

Housing Benefit (ON-CND)

Rent Banks / Housing Stabilization Funds

Additional Refugee and Immigrant programs

Health Care additions such as Drug and Dental Benefits

Education Grants (OSAP)

Learning Bond (additions to RESP)

Legal aid

etc. etc.

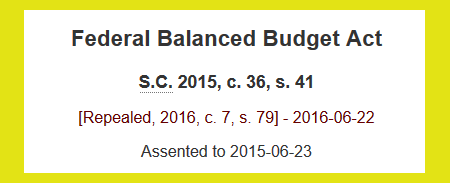

Trudeau (Nov. 15, 2015 - Present) repealed the Balanced Budget Act. (as his Liberal advisors did in Ontario). Unlike most advanced countries in the IMF, Canada requires no plans for returning to balance (and no pay cuts for politicians in deficit!).

Children assume Government debt – and it is doubling. Canada has a UBI – we need to protect the truly vulnerable and powerless with Balanced Budget Legislation (BBL).

https://laws-lois.justice.gc.ca/eng/acts/F-5.8/FullText.html